For Individuals

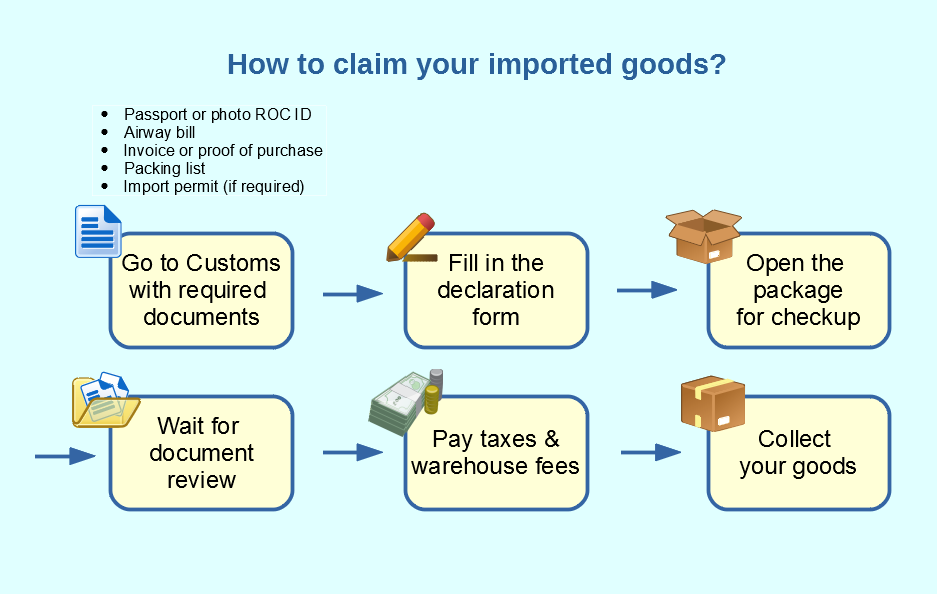

How to claim your imported goods:

1. Go to customs import counter with the following documents (at customs office):

- passport or photo ROC ID

- airway bill

- invoice or proof of purchase with prices

- packing list

- import permit (if required)

2. A customs officer will assist you with filling in the declaration form. (A NT$200 fee will be charged for data key-in service at customs office.)

3. Open the package of your goods for the customs officer to check (at cargo examination zone of the warehouse).

4. Wait for the customs officer to review the documents you hand in (at customs office).

5. Pay taxes and warehouse fees on site (at bank & warehouse).

6. Collect your goods (at warehouse).

Note:

-

Unaccompanied baggage: Be sure to fill in "Declaration Form for Inbound Passesngers" when you arrive at the airport. Otherwise, you may not be exempted from duties. Please check the [Unaccompanied Luggage] section under [Traveler] for detailed information.

-

You will need to obtain an import permit for a restricted item BEFORE you import it.

-

Sometimes, your goods will be examined by authorities other than Customs, such as FDA or APHIA, and it might take more time than you expect. We strongly suggest you come to the customs office as early as possible.

-

Sometimes, the cargo examination zone is not located near the customs office depending on which warehouse your goods are stored at. You will be more mobile to move back and forth if you have your own car.

-

You can also contact a customs broker to manage the process for you at your own cost.

Examples of restricted items that require an import permit (and the authorities that issue import permits):

-

animals (APHIA)

-

dried food over 6 KG or not for personal use (FDA)

-

endangered species of wildlife (foreign CITIES issuing authority)

-

medical equipment (FDA)

-

medicine / controlled drugs (FDA)

-

plants or seeds (APHIA)

-

radio transmitters & telecommunication equipment (NCC)

-

tobacco & alcohol (NTA)

-

weapons or firearms (NPA)

Note:

-

The above list DOES NOT cover all the restricted items. Please be sure to consult Customs before you import the goods.

-

For the whole list, please see consult the Bureau of Foreign Trade, Ministry of Economic Affairs.(What do the codes of import regulations stand for)

For Businesses

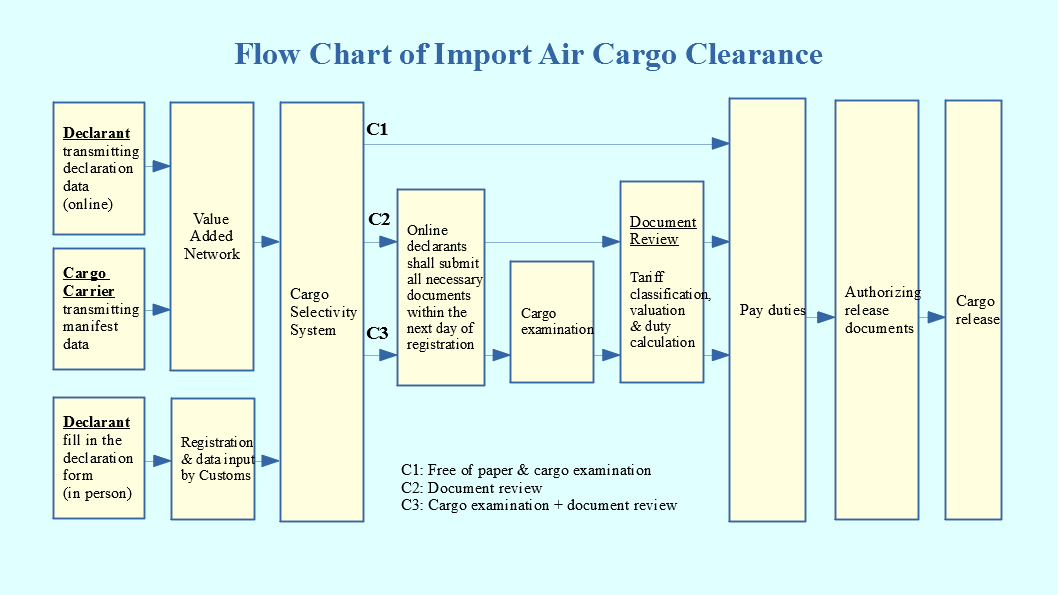

1. Declarant: The duty-payer (recipient or B/L holder) or authorized customs broker shall file the import declaration to Customs.

2. Deadline for Declaration

(1) Declarations shall be transmitted to Customs within 15 days following the date of arrival of the conveyance.

(2) Definition of declaration date:

a. Hard-copy declaration (Non-interfaced users): the day on which Taipei Customs registers the declaration.

b. Electronic declaration (Interfaced users): the day data transmitted to the Trade Van.

3. Steps for Electronic Declaration and Hard Copy Submission

(1) Electronic Declaration

a. Fill in the compulsory columns (starting with the first column and not leaving any column blank).

b. After checking all data, a licensed declaration staff may use a “turn key” issued by Customs or other Customs-approved means to proceed with the electronic declaration.

c. In general (when the number of pending declarations is under 30), a responding message will be received within 15 minutes after transmission. The message could be “error declaration” or “incomplete supply of documents” if a further action is required. Or, if the declaration is complete, accurate and approved as C1*, the responding message may be a Tax Payment Slip or notification of cargo release.

d. For those approved as C2 or C3*, the hard copies shall be submitted to Customs within the business hours of the following day. Otherwise Customs may, based on the violation scenario, give a warning and require to make due rectifications within a given time frame, or impose a fine ranged from 6,000 to 30,000 NT pursuant to Article 81 of the Customs Act. Where necessary, such fine may be imposed time after time.

e. Contents of the hard copies shall be identical to that of the electronic declaration.

f. If there is any discrepancy in the declaration before the clearance channel is decided, Customs would inform applicants to correct online. After the clearance channel is decided, any correction should be made by hard copy.

*

C1: free of document review and cargo examination

C2: document review required

C3: cargo examination and document review required

(2) Hard-copy declaration

a. A non-interfaced applicant shall fill in the declaration form in hard copy and submit it to Customs for registration.

b. Customs will charge for data key-in service.

c. The procedures after the declaration registration shall be the same as that of electronic declaration. However, any correction shall be made manually.

4. The application could be completed through internet, if applicants have a citizen digital certificate or industry and commerce certificate.

(1) Fill in the compulsory columns (starting with the first column and not leaving any column blank).

(2) After the transmission, the status of clearance could be inquired through the computer system, e.g., the clearance channel, error message, taxes and fees payment and cargo release notice, etc.

(3) If the clearance channel is C2 or C3, the procedure of clearance is based on its specific rules.

(4) If any discrepancy is detected by logical checking of the computer system, the applicant should retransmit the correct data through internet. However, if the clearance channel have been approved, any correction needs to be filed in hard copy. All corrections shall be made according to Inspection Rules for Import/Export Goods.

(5) Printing: Customs brokers who transmit through internet can print the declaration form black and white.

5. Necessary documents for declaration:

(1) Air Waybill (AWB)

Non-interfaced applicants should hand in the AWB with the declaration form while interfaced applicants are free from it (the airline company should provide the AWB if requested by Customs).

(2) Invoice or commercial invoice—One copy shall be enclosed.

(3) Packing List (P/L)—One copy for cargoes packed in more than 1 unit (carton, pallet, drum, package, etc.). No P/L is needed for bulk, mass or uniform-package cargoes (whether physical inspection is required or not).

(4) Import Permit (I/P)

Applicants shall submit the original copy of I/P for importing restricted articles as defined in the Consolidated List of Commodities Subject to Import Restriction and Commodities Assisted by Customs for Import Examination, issued by the Bureau of Foreign Trade, Ministry of Economic Affairs. (What do the codes of import regulations stand for?)

(5) Power of attorney

a. Customs brokers should obtain the power of attorney from duty-payers before they transmit the information online.

b. The power of attorney should be co-signed by the duty-payer and the authorized customs broker. However, if the declaration is done electronically, there is no need for the customs broker to sign the power of attorney.

c. Long-term authorization: If a long-term authorization is registered at Customs, there is no need to hand in its photocopy upon declaration. However, its registeration number still needs to be stated at the column Other Declaration Particulars of the declaration form.

(6) Two copies of cargo value declaration

a. To be submitted only on the condition that special relations between the seller and the duty-payer is stated in the declaration.

b. Cargo value declaration is not required for the following cargoes: travelers' luggage; parcels; samples; gifts; duty-free articles; re-imported domestic products; cargoes imported by government agencies and state businesses; and bonded cargoes imported by bonded factories, export processing zones, agricultural technology parks and scientific parks.

(7) Conditions of Certificate of Origin (C/O) Submission

a. To be submitted if import regulations apply.

b. To be submitted when requested by customs officers, according to Article 28 of the Customs Act.

c. To be submitted when applying for the duty-free tariff rate on Column II (imports from less developed countries or countries who signed FTA with ROC).

(8) Catalogues, manuals or drawings--to be submitted according to customs inspection or valuation.

(9) A copy of Import Car Declaration Details shall be submitted for import of cars.

(10) Others—subject to laws and regulations governing corresponding articles, e.g., Pesticide Permit and Pesticide Sales License for import of pesticides; and power of attorney from a license holder to non-licensed importers.

Jhuwei Branch

TEL: +886-3-399-2888 ext. 13630